Content

A program that has substantially the same distribution rules in the case of an employee’s voluntary termination of employment before reaching retirement age or service does not qualify. 3 – Under Pennsylvania personal income tax law, a distribution due to disability generally is not taxable.

- After logging in, select the Benefits tile, then select Qualified Tuition Reduction, then choose QTR Application Form.

- The expense of the program outweighs the benefits to be gained from testing and evaluation.

- Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services.

- Cash and contributions by employers to provide coverage for long-term care services through a flexible spending or similar arrangement.

You cannot file a return on-line if you do not have the state issued account number. Mail your return and payment to the Department by the due date for the filing frequency of your business.

Are Taxable Fringe Benefits Included on a W-2?

For example, if you’re a household https://intuit-payroll.org/, then lodging furnished in your home to a household employee would be considered lodging furnished on your business premises. For special rules that apply to lodging furnished in a camp located in a foreign country, see section 119 of the Internal Revenue Code and its regulations. You figure the total cost to include in the employee’s wages by multiplying the monthly cost by the number of months’ coverage at that cost.

Simple Discounts & Benefits Tax Withholding Work s are treated as meeting the nondiscrimination requirements of a cafeteria plan and certain benefits under a cafeteria plan. Distributions from an HSA may be used to pay eligible long-term care insurance premiums or to pay for qualified long-term care services. Presumably, this method may also be used to determine the amount to include in an employee’s income for discounts provided the employee’s friends. Discounts generally include the employee, his or her spouse and dependent children, former employees who retired or left because of disability, and the widow or widower of a deceased employee (Sec. 132). There are other requirements for tax-free employee discounts you should know about. For example, the coffee shop, Life’s a Grind, has a discount for employees on drinks, tumblers, and pastries.

Language assistance

Employee Stock Purchase Plans are programs where participants have an opportunity to purchase shares of company stock at a discount and via payroll deductions using after-tax income. In a federally declared disaster area, you can get a faster refund by filing an amended return. You will need to claim the disaster-related losses on your tax return for the previous year.

You can receive your refund by check, whether you’re printing or e-filing. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. We’ll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS. You’ll also have unlimited access to the helpful TurboTax community, and a robust set of FAQs and articles if you have questions about doing your taxes. Make sure you’re staying compliant with all state & local business license requirements. Serving legal professionals in law firms, General Counsel offices and corporate legal departments with data-driven decision-making tools.

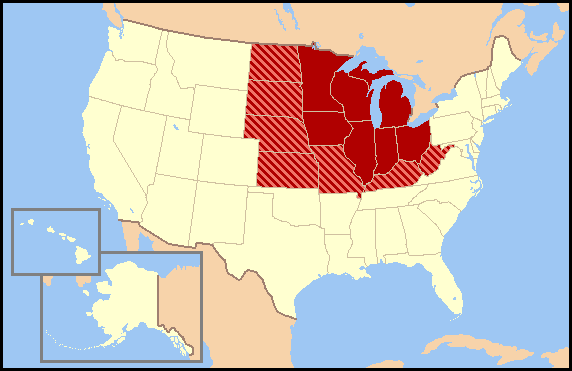

Where Your Employees Are Located

If you have a simple tax return, you can file for free with TurboTax Free Edition or TurboTax Live Assisted Basic. You can also file with TurboTax Live Full Service Basic at the listed price.

Deals: Amazon Discounts 2021 iPads to Record Low Prices (Up to $80 Off) – MacRumors

Deals: Amazon Discounts 2021 iPads to Record Low Prices (Up to $80 Off).

Posted: Wed, 22 Feb 2023 15:21:03 GMT [source]

If there are substantial lapsing restrictions on stock options, they are not considered when determining either the value of the underlying stock or the recipient’s tax liability. If there are some restrictions on the stock that are insubstantial, they will be a factor when determining the value of the option and underlying stock.

The depreciation method elected and the amount of expense must be included on PA Schedule UE. If parties to an employment contract recognize that the employee will pay for some business expenses out of his or her own pocket, these amounts may be excluded from income. However, personal expenses, including daily living expenses of an employee, may not be excluded from compensation. All benefits other than for death, disability, hospitalization, and sickness are taxable under Pennsylvania personal income tax.